By the end of this guide, you’ll have a solid grasp of what standby letters of credit are, why they’re important for businesses, and how they fit into the big picture of credit risk management. Read the Best info about 备用信用证提供者.

Alright, let’s get straight to it. A standby letter of credit (SLOC) is like a safety net for businesses. Imagine you’re a business owner making a deal with a supplier, but they’re a bit worried about getting paid. That’s where a standby letter of credit comes in. It’s basically a promise from your bank that says, “Hey, if this business can’t pay you, we will.”

The Essence of Security

A standby letter of credit acts as a crucial security tool, ensuring that financial transactions are honored even in the face of unforeseen circumstances. This financial instrument is designed to protect the interests of all parties involved, offering a sense of security that can be particularly valuable in high-stakes business environments. By providing a backup payment mechanism, it reduces the potential for disputes and promotes smoother commercial operations.

Building Business Confidence

The presence of an SLOC can significantly enhance the confidence of suppliers, enabling them to engage in transactions with minimal hesitation. This increased confidence can facilitate more favorable terms and conditions, potentially leading to better pricing, extended credit terms, or more flexible agreements, ultimately benefiting the business in the long run.

The Role of Financial Institutions

Banks play a pivotal role in the issuance of standby letters of credit. They not only assess the creditworthiness of the applicant but also provide the financial backing that underpins these letters. This involvement of reputable financial institutions ensures that the SLOCs are reliable, adding an extra layer of assurance for all parties involved in the transaction.

Why Businesses Use Standby Letters of Credit

Standby letters of credit are particularly useful because they help manage credit risk. They provide peace of mind for all parties involved in a transaction. Here’s why you might want to consider them for your business:

Building Trust

Standby letters of credit are instrumental in building trust, a critical component of any successful business relationship. They demonstrate a company’s commitment to fulfilling its obligations, reassuring suppliers and partners of the firm’s reliability. This trust can lead to stronger, long-lasting partnerships that are beneficial for business growth.

Risk Management

Risk management is at the heart of why businesses choose to use standby letters of credit. By providing a financial safety net, these instruments mitigate the risk of non-payment and protect businesses from potential financial losses. This risk reduction is particularly important in international trade, where the complexities of cross-border transactions can increase the likelihood of payment issues.

Facilitating International Trade

Standby letters of credit are especially valuable in facilitating international trade, where trust issues often arise due to differences in legal systems, cultural norms, and business practices. By offering a guarantee of payment, SLOCs enable businesses to enter new markets with confidence, expanding their global reach and opening up new revenue streams.

How Does a Standby Letter of Credit Work?

Let’s break it down step-by-step:

Agreement Stage

The process begins with the agreement stage, where both parties negotiate and agree on the terms of the transaction. This stage is crucial as it lays the foundation for the entire process. Clear communication and mutual understanding during this phase ensure that both parties are on the same page, reducing the likelihood of disputes later on.

Application

Once the terms are agreed upon, the next step is to apply for a standby letter of credit with a bank. This involves submitting the necessary documentation and demonstrating creditworthiness to the financial institution. The application process requires careful attention to detail to ensure that all relevant information is accurately provided.

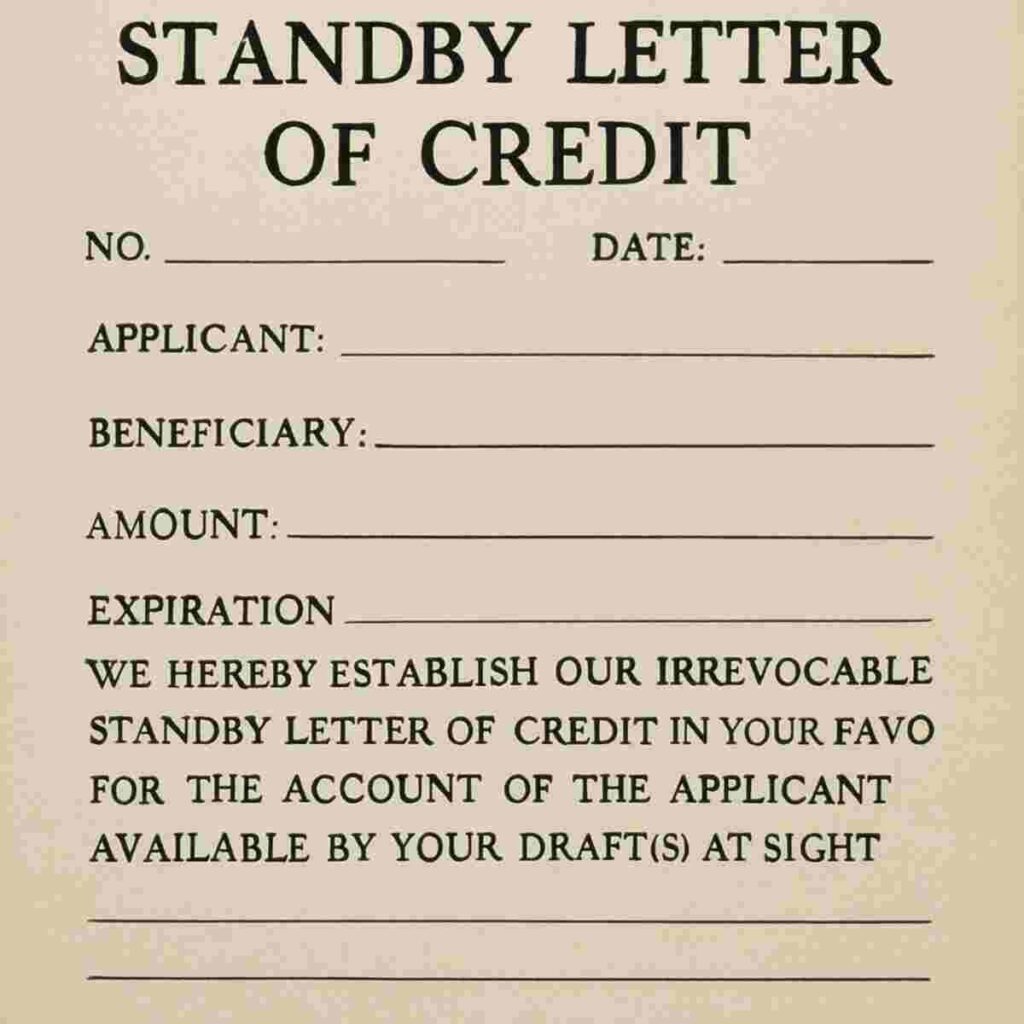

Issuance

Upon approval, the bank issues the standby letter of credit to the beneficiary or their bank. This issuance is a formal commitment by the bank to fulfill the payment obligation if the applicant fails to do so. The SLOC serves as a binding agreement, and the terms and conditions outlined in the document must be adhered to by all parties.

Transaction

With the SLOC in place, the transaction can proceed as agreed. The presence of the SLOC provides peace of mind to both parties, knowing that the financial aspects of the transaction are secured. This assurance allows for smoother operations and a focus on delivering the agreed-upon goods or services.

Payment

Ideally, if everything goes smoothly, the standby letter of credit is not utilized. However, in the event of non-payment or a contractual breach, the beneficiary can present the necessary documentation to the bank and claim the payment. This process ensures that the beneficiary is compensated, safeguarding their financial interests.

Types of Standby Letters of Credit

There are a couple of different types of standby letters of credit that serve various purposes:

Performance Standby

A performance standby letter of credit ensures that a business completes a project or fulfills a contractual obligation. If the business fails to meet its obligations, the beneficiary can claim compensation from the bank. This type of SLOC is particularly common in industries such as construction and manufacturing, where project completion is critical.

Financial Standby

Financial standby letters of credit act as a guarantee for the payment of financial obligations. If the buyer fails to pay, the bank steps in to cover the cost. This type of SLOC is commonly used in transactions involving large sums of money, ensuring that financial commitments are honored even in the event of unforeseen circumstances.

Bid Bond Standby

A bid bond standby letter of credit is often used in the context of competitive bidding processes. It guarantees that the bidding company will honor its bid and, if awarded the contract, will enter into the agreement. This provides assurance to project owners that the bidder is serious and financially capable of completing the project.

Choosing a Standby Letter of Credit Provider

Choosing the right standby letter of credit provider is crucial. Here are some tips to help you make the best choice:

Reputation

The reputation of the standby letter of credit provider is a critical factor to consider. A provider with a solid track record and positive customer reviews is more likely to deliver reliable and trustworthy services. Conducting thorough research on potential providers can help you make an informed decision.

Experience

Experience in your industry or region can be a valuable asset when selecting a provider. An experienced provider will have a deep understanding of the specific challenges and requirements of your business environment, allowing them to offer tailored solutions that meet your needs.

Transparency

Transparency is essential when choosing a standby letter of credit provider. Ensure that the provider offers clear terms and conditions without any hidden fees. A transparent provider will communicate openly and provide all necessary information upfront, allowing you to make well-informed decisions.

Tips for Using Standby Letters of Credit

Now that you know what they are and how they work, here are some practical tips for using standby letters of credit effectively:

Clear Communication

Clear communication is vital when dealing with standby letters of credit. Ensure that all parties involved understand the terms and conditions of the SLOC. Miscommunication can lead to misunderstandings and disputes, so it’s crucial to maintain open lines of communication throughout the process.

Documentation

Proper documentation is key to the successful use of standby letters of credit. Keep all relevant paperwork organized and easily accessible. This includes the SLOC itself, any amendments, and all correspondence related to the transaction. Well-maintained documentation can expedite the claims process if the SLOC needs to be utilized.

Review Terms

Always review the terms of the standby letter of credit carefully before agreeing to anything. Pay close attention to the conditions under which the SLOC can be drawn upon, as well as any expiration dates or other critical details. Understanding these terms will help you avoid potential pitfalls and ensure that the SLOC serves its intended purpose.

Real-World Applications

Standby letters of credit can be a game-changer for businesses in various sectors. Here are a few examples:

Construction

In the construction industry, standby letters of credit are often used to assure clients that a project will be completed as agreed. A performance standby can provide clients with the confidence to proceed with large-scale projects, knowing that they have financial protection in case of delays or non-completion.

Import/Export

For businesses involved in import and export activities, financial standby letters of credit are invaluable. They guarantee payment from international buyers, reducing the risk of non-payment due to foreign exchange fluctuations, political instability, or other factors. This assurance enables exporters to expand their market reach with confidence.

Infrastructure Projects

Large infrastructure projects, such as roadways, bridges, and public transportation systems, often involve significant financial commitments. Standby letters of credit provide the financial backing needed to secure contracts and ensure that projects are completed on time and within budget. These instruments are essential for managing the complexities and risks associated with such undertakings.

Common Misunderstandings

Let’s clear up some common misconceptions:

Not Immediate

A standby letter of credit is not a direct payment method. Instead, it acts as a backup plan, providing financial security in case of non-payment or contractual breaches. It’s essential to understand that the SLOC is a contingent financial instrument, not a primary means of payment.

Not Always Used

Ideally, the standby letter of credit is never actually used. Its purpose is to serve as a safety net, providing assurance to the parties involved. Most transactions proceed smoothly without the need to draw on the SLOC, but its presence offers peace of mind in case of unforeseen issues.

Not a Substitute for Due Diligence

While standby letters of credit offer valuable financial protection, they are not a substitute for thorough due diligence. Businesses must still conduct comprehensive assessments of potential partners and transactions to ensure they are entering into sound agreements. An SLOC should complement, not replace, prudent business practices.

Wrapping Up

Understanding standby letters of credit is a valuable skill for any business owner. They’re an essential tool in credit risk management, helping you build trust and reduce risk in your business transactions.

By using standby letters of credit wisely, you can open doors to new opportunities and partnerships, making your business more resilient and trusted by partners and clients alike. These instruments are not just about financial protection; they’re about fostering stronger business relationships and enabling growth.

And there you have it! A comprehensive, easy-to-understand guide to standby letters of credit. Whether you’re just starting out or looking to expand your business, keep these insights in your back pocket for future dealings.

Now, get out there and make those business deals with confidence!